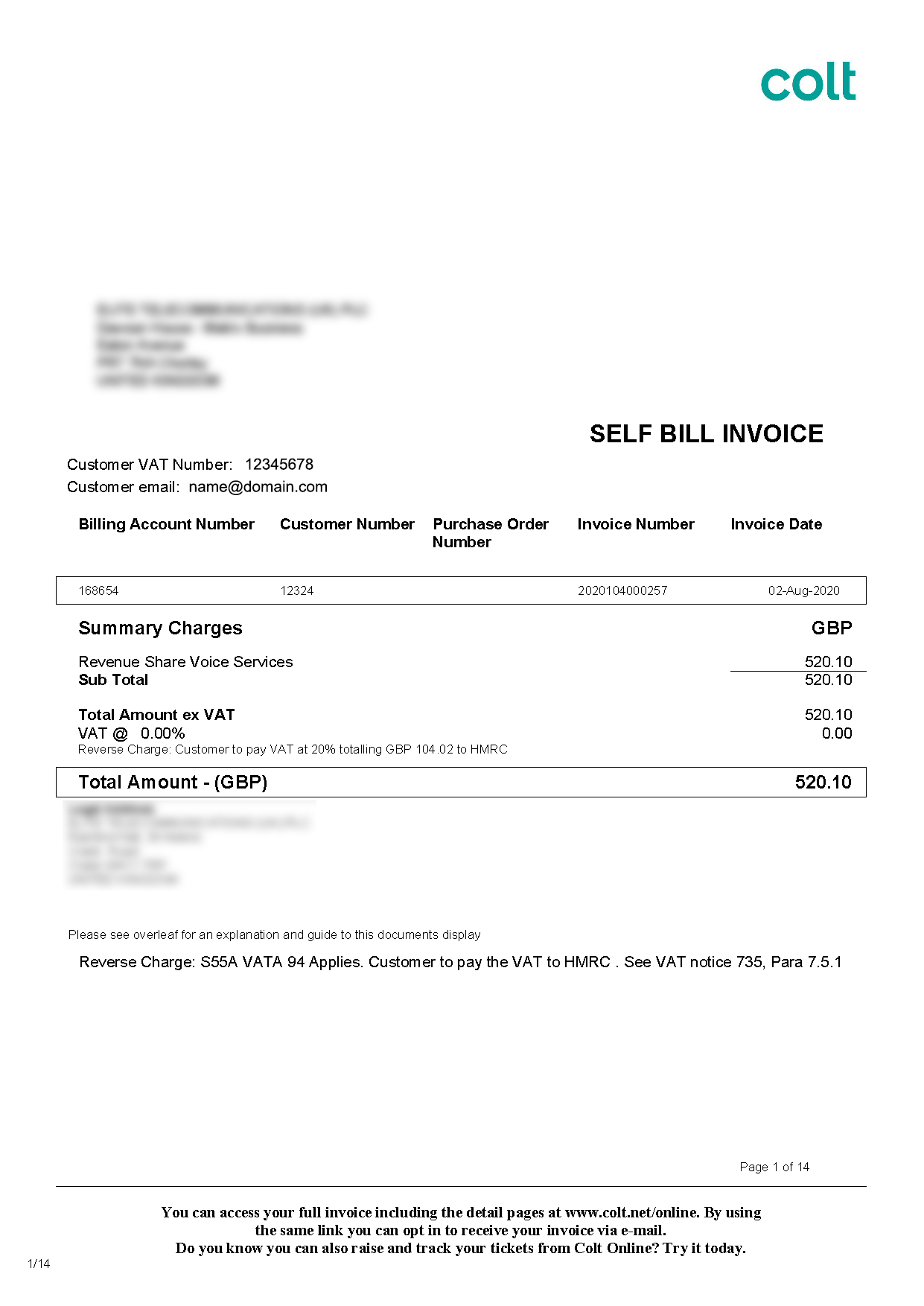

Self Bill Invoice

The footer appears at the bottom of every invoice page and includes Microsoft business center address. What is Self Invoicing.

Even if youre not ready to jump in with an invoice maker starting out with a self-employed invoice template is a great option.

. Save you time in the long run as you reuse the same template. Selecting a hotel invoice template that serves the needs of both you and your customers is of utmost importance. Bill Gates Warren Buffett Oprah Winfrey Elon Musk Mark Cuban and Jack Ma are all voracious readers.

Noun an itemized list of goods shipped usually specifying the price and the terms of sale. NW IR-6526 Washington DC 20224. Self-invoicing is to be done when purchased from an unregistered supplier and such purchase of goods or services falls under reverse charge.

The Bank purchases the bill Promissory Note before its due date and credits the bills value after a discount charge to the customers account. It is a sales tax charged by VAT registered traders on the value of the goods or services supplied to their customers. A self-billing invoice is an arrangement between the supplier and the buyer wherein the customer prepares the invoice for the supplier and sends them a copy along with the payment.

Automate invoicing and get paid 2x faster. A standard invoice is a simple bill stating how much the customer owes the hotel. These may specify that the buyer has a maximum number of days to pay and is sometimes.

Use a self-employed invoice template for professional freelance invoicing. Using a self-employed invoice can. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

Information for self-billees suppliers 61 Identifying customers that are intending to self-bill. Hence self-invoicing in this case becomes. Based on your country or region it might include other information like the phone number to call for billing or technical support a link to online self-help articles and the address and tax ID for Microsoft in your country or region.

The Invoice Simple App requires Android 41 or higher or iOS 90 or later. You need to write a tax invoice and include the GST for each applicable item. VAT is Value Added Tax.

It allows on the spot estimates to be turned into invoices to close the deal and get you paid. Simplify AR in five steps. Instead of sending a PayPal invoice to your clients which will automatically make the payment a business payment that is subject to the 049 plus 349 fee send them an invoice via an accounting program or make one on a spreadsheet manually.

Not registered for GST. Rental price 70 per night. In most cases it involves the customer preparing the invoice and sending it along with the payment to the supplierThis kind of financial arrangement brings much-needed ease to transactions and virtually rids the supplier of the responsibility to write and send an invoice to their customer.

There are multiple types of invoices that are available to record your customers charges and transactions. Make a payment. Self-billing is a financial agreement between a customer and a supplier.

See key workflows in action like bill approvals and coding and making domestic and international payments. 1 2020 and required companies that hire independent. Pay in 1 of 3 convenient ways.

Online by email or with a credit debit or health savings card. Both parties have to be VAT registered for this prior agreement. This is because your supplier cannot issue a GST-compliant invoice to you and thus you become liable to pay taxes on their behalf.

This bill is for laboratory testing fees only and is separate from any bill you may have received from your physician andor paid at your physicians office. Information may be abridged and therefore incomplete. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

What is VAT. You can write a simple invoice or regular invoice which doesnt need to include the GST for each item. QuickBooks Online QuickBooks Self-Employed and QuickBooks Payroll require a computer with Internet Explorer 10 Firefox Chrome or Safari 6 and an Internet connection a high-speed connection is recommended.

As explained below the law requires UK traders with sales turnover above the VAT threshold to register for VAT and charge it on supplies of goods or services. The management software comes with a fully integrated website that allows tenants to e-sign lease agreements rent units online and pay their bill via their own online account. The next section in invoice is the Bill to section which contains the details of your customer.

A receipt is different from an invoice in that an invoice is requesting payment for products or services received whereas a receipt is proof that the services or products have already been paid for. We welcome your comments about this publication and your suggestions for future editions. In other words an invoice is sent and a bill is received.

An invoice and a bill are documents that convey the same information about the amount owing for the sale of products or services but the term invoice is generally used by a business looking to collect money from its clients whereas the term bill is used by the customer to refer to payments they owe suppliers for their products or services. An invoice bill or tab is a commercial document issued by a seller to a buyer relating to a sale transaction and indicating the products quantities and agreed-upon prices for products or services the seller had provided the buyer. It also has the ability to text message and email tenants late notices and invoice reminders.

As Gates told The New York Times reading is one of the chief ways that I learn and has. California Assembly Bill 5 AB5 popularly known as the gig worker bill is a piece of legislation that went into effect on Jan. When your invoice gets paid you receive the remaining 10-30 of the invoice minus the companys processing fee.

However when you receive an invoice you would enter it as a bill that you owe. Likelihood of Use The portable flexible nature of Invoice Simple both as a free invoice app and a paid service makes it ideal for todays entrepreneurial business person. Keep you organized with expenses and taxes.

Payment terms are usually stated on the invoice. The invoice you use depends on whether your business is registered for GST Goods and Services Tax. Bill Discounting is short-term finance for traders wherein they can sell unpaid invoices due on a future date to financial institutions in lieu of a commission.

Invoicing is a breeze once youve mastered the basicsand with QuickBooks a well-made invoice personalized for your precise business needs is easily accessible. The notional tax point is the day after the date the self-bill invoice was issued. Customer support and software upgrades are 100 FREE.

Get set up and send your first invoice in minutes. The trader charges the VAT and then pays it over to.

Free Self Billing Invoice Template Pdf Word Excel

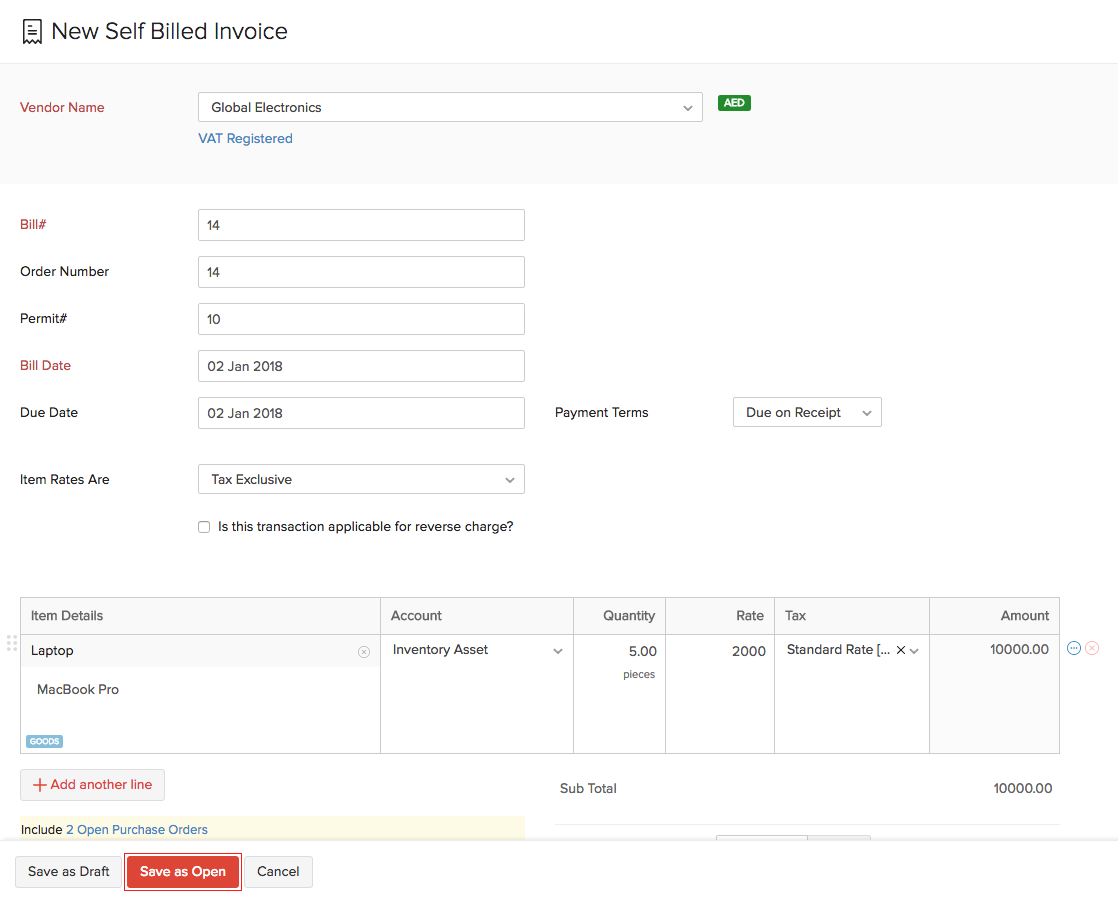

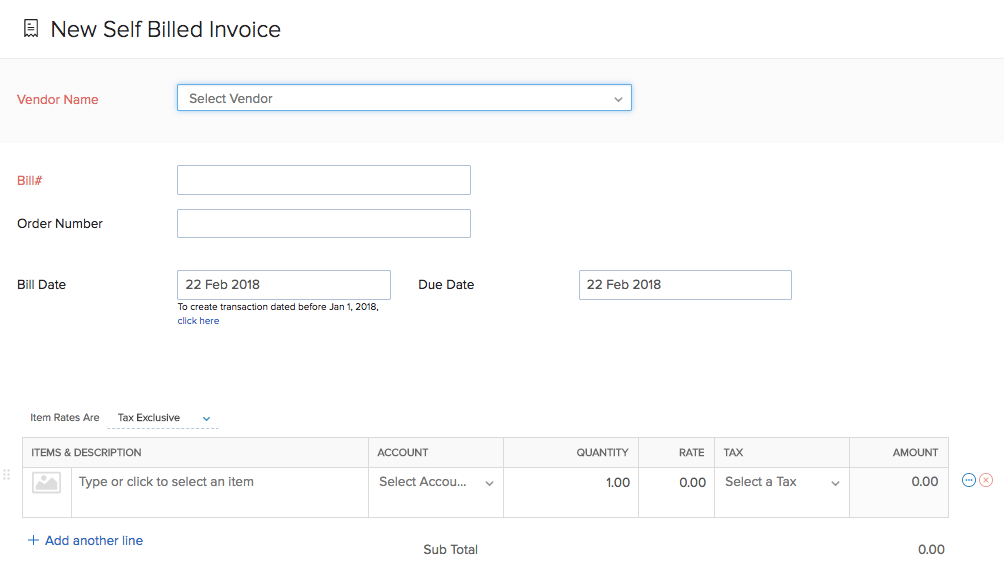

Creating A Self Bill Invoice On Behalf Of Your Artist Curve Royalty Systems Knowledge Base

Self Billed Invoice The Process Conditions

Self Billed Invoices User Guide Zoho Inventory

Self Billed Invoices Colt Technology Services

Self Billing Raising Vat Invoices With Xero Caseron Cloud Accounting

Self Billing Raising Vat Invoices With Xero Caseron Cloud Accounting